Industry Trends: Baby 2/26/2016

- There are nearly four million new babies born each year in the U.S. *cdc.gov

- Total U.S. spending on baby products, including toys, grooming, formula, and durable goods like cribs, was at over $23 billion in 2013

- U.S. sales of baby toys and games totaled more than $487 million in 2013

- Formula sales added up to about $5 billion last year in the U.S. alone, according to *Euromonitor

- As of 2014

- Baby nutrition and food contribute the most revenue to the Baby Product Manufacturing industry at 34.9% in 2015.

- Tools and furniture for infants contribute the second largest revenue share at 30.3%. Baby diapers, feeding bottles, baby strollers and cots are included in this segment. *IbisWorld

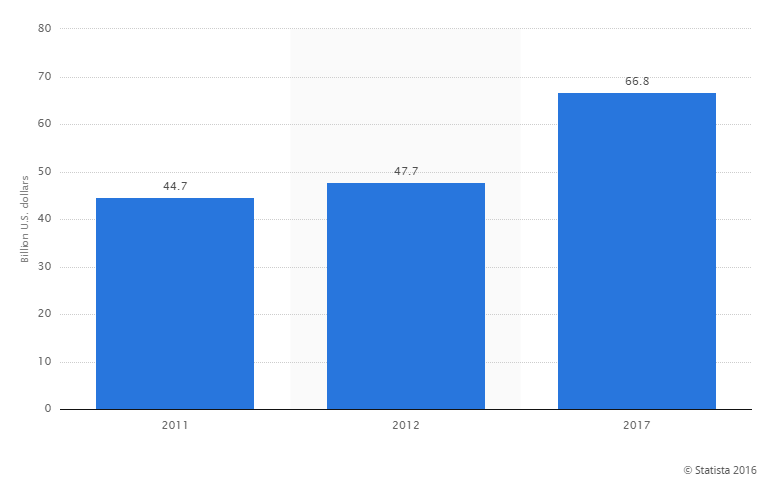

- The baby care market was worth 44.7 billion U.S. dollars in 2011 and is expected to increase total sales to 66.8 billion U.S. dollars by 2017 (see chart A)

Focus on Food - In 2012, parents spent $6.5 billion on baby food. The market is expected to grow 22% through 2017 to $8 billion. *Mintel The trend towards organic food for adults is just as important for the baby food industry. In 2013, U.S. consumers spent $613 million on organic baby food and $68 million on organic milk formula, up from $453 million and $62 million, respectively, in 2008. *Euromonitor. Almost half of new launches from 2007-2012 touted the organic claim and sales in natural supermarket channels saw a 63% increase during 2011–2013. Organic was a common theme of companies targeted for acquisition. *Mintel

E-Commerce - New parents are increasingly shopping online, making the online baby-products business one of the most successful segments in the retail landscape. *IBISWorld Online sales of baby products grew at an annual rate of 14.5% from 2008 to 2013, to $5.6 billion. Diapers account for 41% of all online baby-related purchases. *MarketWatch It’s estimated that by 2018 there will be more than 6,000 companies looking to sell products via e-tail. *Inc.com

Increased Spending and Duration - Possible growth drivers for this market increase can be attributed to the fact that baby care products are used for longer periods by the infants as well as the fact that parents want the best available products for their baby, therefore disregarding the cost of certain products. *Statista

“Mommy Blogs” - Social media has vastly expanded the ways that new parents can share with one another. Influential so-called mommy bloggers have expanded beyond blogs to Pinterest, Facebook and Instagram. Companies, meanwhile, know the products they give these bloggers to review will be posted and pictured in multiple forums. *Marketwatch

China – As of November, 2013, China announced the decision to relax the one-child policy. Under the new policy aimed at addressing China’s aging population, families can now have up to two children. Coupled with continued growth and higher standards of living, China remains fertile for growth across all of the major baby industry products. *The Guardian

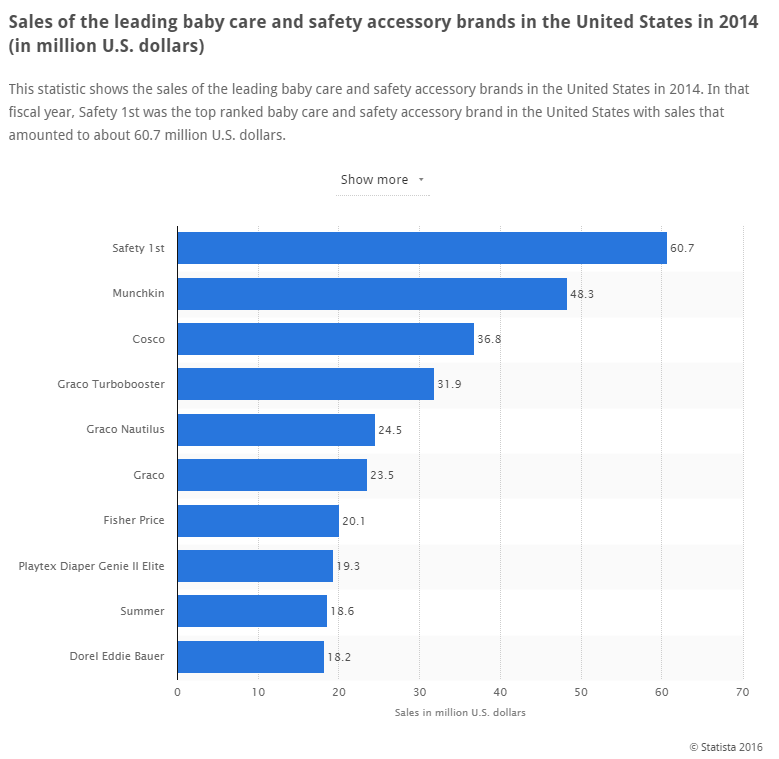

Safety First – One of the strongest segments of the baby industry include products that promote safety and care. Two of the most primal concerns of any parent.

For more information about this event, please contact Melinda Young at 440-248-2190 or MCYoung@ECRM.MarketGate.com.

Other Content Gateway Articles that Might Interest You:

Product Showcase: Baby & Infant

Phil Lempert's Pick of the Week (December 11)