Industry Trends: Specialty Toy 1/21/2016

The specialty toy industry is booming. With growth in online retail outlets along with other trends, the specialty toy category has shown significant growth over the last few years. Take a look at the below article for an overview of the industry as it stands now and where it is headed in the future.

Childhood Obesity: The number of obese children in the US grew from 5% in 1980 to nearly 20% in 2012, according to the Centers for Disease Control and Prevention. Toys that promote physical activity can help address children's growing weight problems. (*Hoovers)

Industry Opportunities

Targeting Grandparents: Grandparents account for as much as 25% of US toy spending. (*Toy Industry Association). With more disposable income than previous generations, grandparents are better able to indulge (AKA spoil!) their grandchildren. (*Hoovers)

Industry Challenges

Internet Retailers: Independent stores have a competitive advantage against big box retailers because they can carry a deep selection of specialty toys. This same advantage doesn’t exist when competing with online retailers. Online retailers are often able to offer a significant discount while also not requiring any sales tax. (*ilsr.org).

Smart Phones: Shoppers are regularly using their smart-phones to compare prices while they are at the brick-and-mortar stores. Many online retailers even offer apps to scan barcodes to quickly determine availability and price.

At a Glance: The Broader Toy Industry

- The toy industry’s annual total economic impact in the U.S. is calculated at $76.71 billion.

- The average price of a toy is around $10, but the estimated 3 billion units sold across the nation each year generates approximately $22 billion in direct toy sales.

- The toy industry supports an estimated 491,600+ jobs (FTE) generating more than $24 billion in wages for U.S. workers.

- The toy industry also generates nearly $10 billion in tax revenue each year (combined State taxes of $4.34 billion; combined Federal taxes of $5.59 billion). (*toyassociation.org)

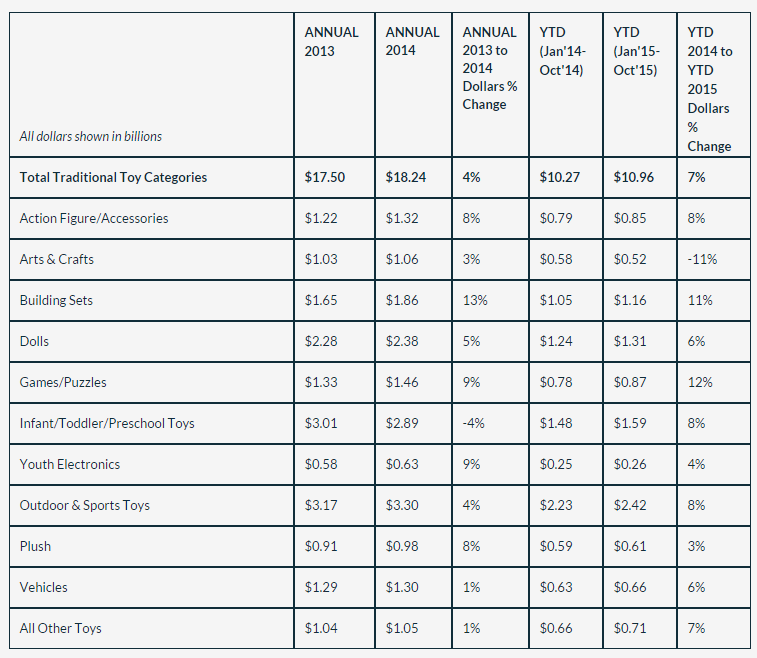

NPD Group’s Retail Tracking Service estimates domestic toy sales for 2014 to be in the $22 billion range. Year-to-date sales data for January 2015 - October 2015 shows a 7% increase in domestic toy sales from the same period in 2014. See Chart A below.

Join us for the 2016 Specialty Toy event taking place April 18-20 at the Westin Westminster in Westminster, Colorado. During this event specialty toy suppliers will present and review new products and programs, marketing initiatives, and promotional opportunities to specialty retailers, catalogs and wholesalers.