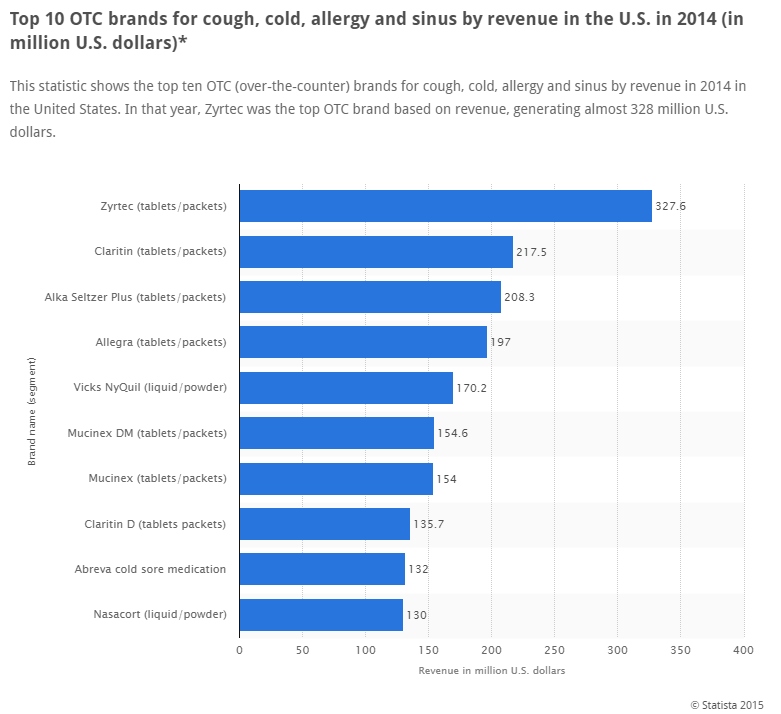

2017 Industry Trends: Cough/Cold, Analgesics & Allergy 10/5/2016

"COLD" HARD FACTS

- One billion people will get a cold this year

- Adults will suffer an average of two to four colds per year

- Young children may suffer an average of six to eight colds

- Colds account for more doctor visits than any other condition

- Peak cold season is generally September to May.

*American Lung Association

- Annual Revenue of OTC cold medicine is approximately $8 BILLION *IBISworld

- Annual Growth 2010-2015 of 1.9%*IBISworld

- Those aged 18-24 are least likely to use OTC remedies and are more likely to say they don’t treat the ailments.**Mintel

- Almost six out of 10 who use OTC products to treat cold, flu, and allergies say they keep these products on hand for when they need them. Only 31% say they purchase when they begin feeling symptoms. *IBISworld

Consumer want products that are effective and safe. One way retailers could respond to safety concerns is by offering homeopathic remedies. The United States has lagged behind the rest of the world when it comes to the popularity of homeopathic medicine but U.S.A., homeopathy has grown from a $200 million category to a $1.5 billion category over the last decade. * Homeolab

Cold season goes hand-in-hand with lip care. The market for this tiny personal care item is anything but.

- The market is projected to reach $2.1 billion by 2020

- Growth Trends and Key Drivers:

o Demand for organic and natural products **Mintel

- The global allergy diagnostics market was valued at nearly 3 billion USD in 2016

- The allergy diagnostics market is projected to be worth over 5 billion USD by 2021

- The major factors driving the growth of this market are increasing number of allergens and increasing healthcare expenditure worldwide *MarketsandMarkets 2016

- Allergy remedies are typically determined by the severity of the season. Recent severe allergy seasons have been positive news for the market. Sales have increased and are expected to continue to climb thanks to milder temperatures and increased pollen counts, which lead to higher incidence of allergies and therefore a greater need for allergy treatments. * Mintel

The use of humidifiers is common among allergy, and cough/cold sufferers.

- The indoor humidifier market was valued at US$212.4 million in 2013 and is expected to reach US$300.4 million in 2020.

- The steady growth of the indoor humidifier market in North America is largely due to the growing awareness about maintaining indoor air quality, especially in commercial spaces.

- Growth is also seen in the introduction of energy-efficient indoor humidifiers and integration of HVAC equipment with humidifiers.*Transparency Market Research 2016

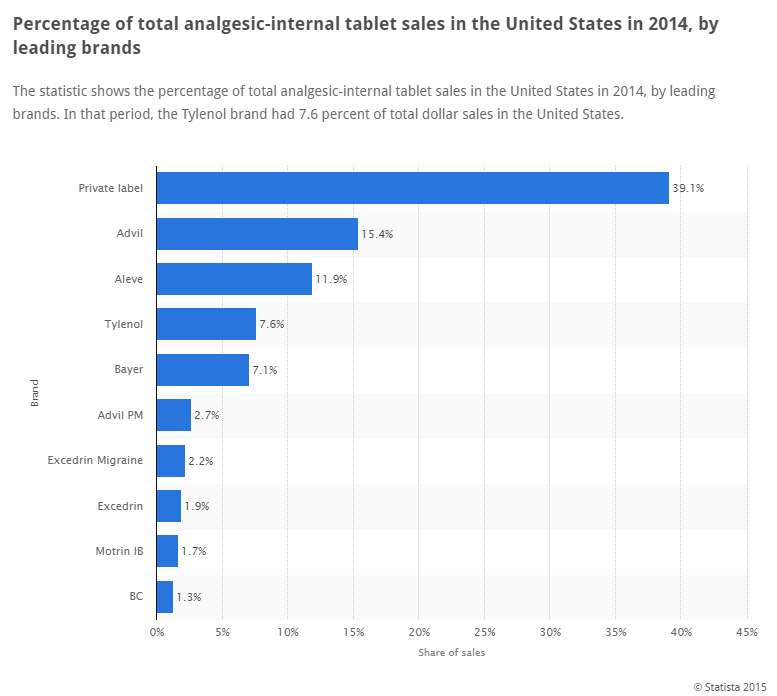

ANALGESIC TRENDS

- Private label analgesics make up nearly 40% of the total market.

- As Johnson & Johnson and Novartis push to get their largest analgesics brands back to pre-recall levels through a series of awareness campaigns, many consumers shift their purchasing preferences back to branded products. This helped the category to continue to thrive in 2014, achieving the second-strongest single-year growth in retail value sales of the past decade, trailing only 2013 when several brands were reintroduced to the market. *Euromonitor International

- Private label OTC sales are giving brand names a run for their money, thanks to both name-brand recalls and a desire on the part of consumers to save money.

- Across the board in OTC remedies, there has been an increase in private label sales—both as a reaction to Johnson & Johnson recalls and as a cost saving measure. *Mintel

PACKAGING, BRANDING & MESSAGING

Store brand and private brands (such a Nyquil) that offer combination packs targeting both daytime and nighttime symptoms are doing well. The same is true for products that treat allergy symptoms, due to progressively worse allergy seasons.

CONSUMER REPLENISHMENT

Encourage consumers to replenish their supply of products each season. Remind consumers to check expiration dates. Since 43% of remedy users throw out expired products, this could be an opportunity to increase purchase cycles. *Mintel