Industry Trends: On-Premise Adult Beverage 6/15/2016

Fast Facts

- There are over 65,000 bars, taverns and nightclubs in the U.S. *Statista

- Total employment at U.S. bars, taverns and nightclubs is over 360,000. *Statista

- Major sources of US industry revenue include beer (about 35% of sales), distilled spirits or hard liquor (35%), food and nonalcoholic beverages (15%), and wine (about 10%).

- On-premise sales tend to be slightly seasonal, with a peak during summer months. *Hoovers

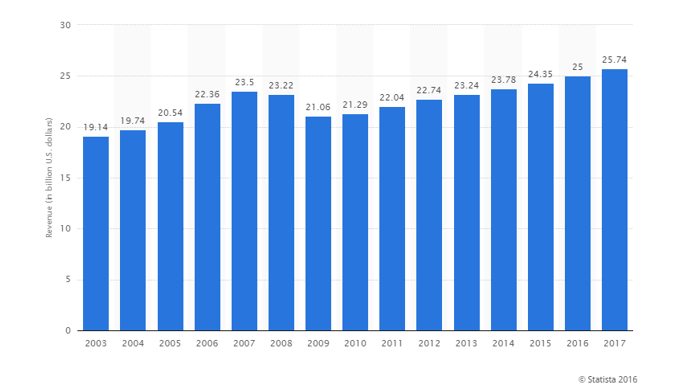

- The revenue of the bar, tavern and nightclub industry in the United States exceeded 24 billion U.S. dollars in 2015. *IBISworld

- Figure A shows the revenue of the U.S. bar, tavern & nightclub industry from 2003 to 2017.

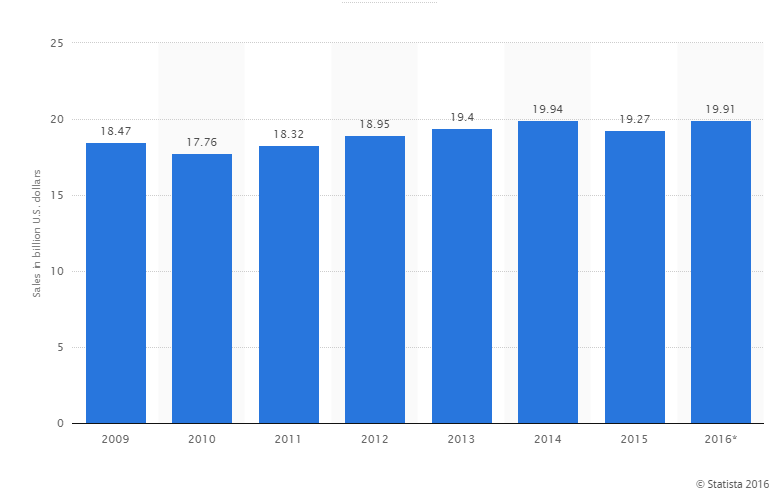

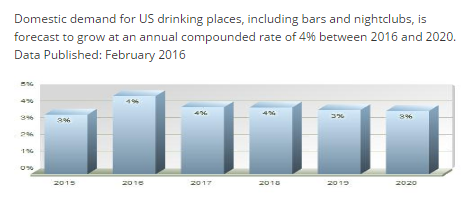

- Figure B and C show the food and drink sales of bars and taverns in the United States from 2009 to 2016. Sales of U.S. bars and taverns were forecasted to rise to approximately 19.91 billion U.S. dollars in 2016.

Trends and Opportunities

Social Media and Increasing Influence of Millennials — Millennials, the newest generation of consumers to reach legal drinking age, number about 80 million and are an important new market for bars and nightclubs. By 2018, 100 percent of Millennials will be of legal drinking age, and their purchasing power will contribute significantly to beverage sales. Millennials are more linked into social networks and use social media more often than older generations. Their preferences and ties to social media are shaping the way bars and nightclubs market leverage online and social media platforms. *Hoovers

When targeting Millennials, focus on premium, high quality beer, wine and spirits. Also note that Millennials more likely to trade up upon server suggestion. *Bevindustry.com

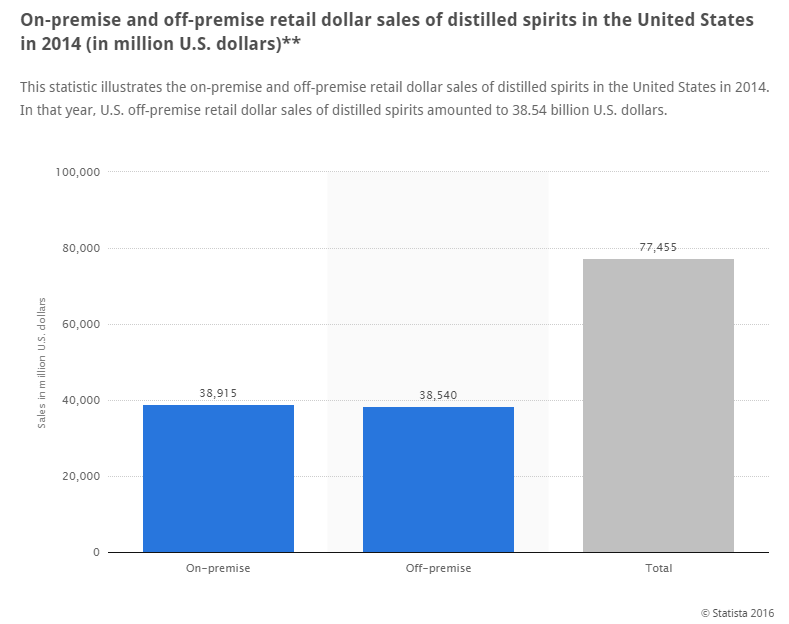

It’s Not All About Millennials: Older Customers Shift to Liquor, Wine — The aging population has driven demand for liquor and wine, and astute companies have adjusted product mix accordingly. Per capita consumption of liquor and wine has increased, driven by baby boomers graduating to more sophisticated drinks. Bars and nightclubs can take advantage of the growing market for distilled spirits, since the on-premise market for hard liquor is larger than that for liquor consumed at home. Demand for vodka has been especially strong. *Hoovers

- Focus on Craft and Imported Beer: The two categories combined are expected to account for 45.6% of total on-premise beer volume in 2015, up 10 points from 2011.

- Focus on Cost: Cost is one of the primary motivations in drink selection. Younger consumers in particular are paying attention to drink cost, however, less than one-quarter of consumers say that price is more important than quality.

- Focus on Women: Women's drink selections are more likely to be influenced by samples and recommendations from bartenders and servers or suggestions than are men's. *Technomic

- Focus on Drink Menus: Adult beverage items on leading restaurant menus are declining (-2.2% YOY as of Q3-2015), following the general trend towards smaller, more focused food menus. *Technomic - See Figure E below.

Flat Category Demand

Increasing sales can be difficult due to flat alcoholic beverage consumption. Per-capita consumption of alcohol in the US has remained relatively constant in recent years, at about 2.5 gallons of pure alcohol per person annually, according to the World Health Organization. Declining demand for beer (the majority of the market) offsets consumption gains for wine and hard liquor. In dollar terms, however, sales of alcoholic beverages at US bars and nightclubs are growing modestly as rising consumer spending has allowed some operators to increase drink prices *Technomic.

Regulation

Federal, state, and local government regulations can restrict a company’s operations, and changes (like earlier closing times or reduced legal thresholds for drunk driving) can significantly affect sales. Liquor law violations, particularly those involving underage drinking, can result in various penalties ranging from a stiff fine to permanent closure. In addition, excise tax increases can result in higher distributor prices, affecting profitability. *Hoovers

Dependence on Consumer Spending

Consumers consider going to bars and nightclubs a leisure activity, and traffic and sales depend on personal spending. During the last recession, bar and nightclub sales growth slowed, as did growth for on-premise alcohol sales across all outlets. Consumers are more likely to entertain at home or limit nights out during difficult economic times. Even if a company maintains traffic, patrons may forgo high-end liquor or drink less. Personal income also affects leisure travel, and fewer tourists hurt industry sales. *Hoovers