Writing Instruments Drive School & Office Products Growth: NPD 2/20/2016

The U.S. office and school supplies industry grew 3 percent in 2015 to $12 billion, with $1.2 billion stemming from online sales, according to retail sales data from global information company The NPD Group, Port Washington, N.Y.

The bulk of the industry’s revenue came from the writing instruments category, which represented 20 percent of total industry sales, and was the thrust behind its growth in 2015; the category experienced dollar and unit growth of 8 percent, and 7 percent, respectively.

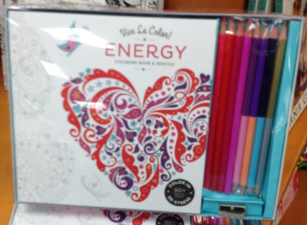

“From writing to adult coloring, a number of exciting trends emerged and reemerged in 2015 which helped grow dollar sales for key players in the office supplies industry,” said Leen Nsouli, office supplies industry analyst, The NPD Group. These trends continue to have a positive impact on sales.”

Coloring Instruments Up 28 Percent

Amidst the digital migration being seen across industries, the traditional writing category has managed to grow and, at the same time, evolve with the times, as new products on the market show. Traditional pen sales grew 5 percent during the year, and specialty pens by 11 percent. In line with the adult coloring book trend, dollar sales of porous, gel, and multi-colored pens were up by 28 percent, 9 percent, and 8 percent, respectively. Colored pencils were also popular items, with sales up 40 percent for the full year. Consumers are also spending on fine writing instruments, and increased their spending by nearly $2.5 million on fountain, gel, and ballpoint pens compared to what they spent on these products in 2014.

While the pen category saw sales increase, 2015 marked a shift in the purchasing of pens versus pencils during the back-to-school season, with traditional pen sales losing unit share to encased and mechanical pencils. Looking at back-to-school shopping purchases, consumers traded 27.6 million individual units of pens for pencils in 2015.

“There is a lot of creativity and innovation in both pens and complementary products,” said Nsouli. “Whether it’s taking notes in an office meeting, journal keeping, coloring, or finding that special lifestyle or luxury pen, many consumers are still handwriting. The comeback of the pencil could be due to a number of factors, including the increased mention of encased pencils on K-6 school lists, growth of large pack sizes in pencils, or the increased purchase rate of specialty pens like the stylus pen, which are an attractive option for consumers looking to blend traditional writing and technology.”

Looking at channel performance, the writing category experienced growth across all retail channels—brick-and-mortar, online, and food/drug stores—and outperformed the overall supplies industry in each.

“The keys to growth in supplies—whether for the office, school, or crafting—are all about innovation and price,” said Nsouli. “I’ve seen this done through new styles and design, new licensing agreements, a blending between glass and paper, and the creation of a new activity like adult coloring, which lead the way to increased sales across supplies categories.”

The NPD Group provides market information and business solutions to help brands drive better decision-making and better results. Practice areas include apparel, appliances, automotive, beauty, consumer electronics, diamonds, e-commerce, entertainment, fashion accessories, food consumption, foodservice, footwear, home, mobile, office supplies, retail, sports, technology, toys, video games, and watches / jewelry.