Industry Trends: Gourmet Confectionery 6/22/2017

Sweet Facts

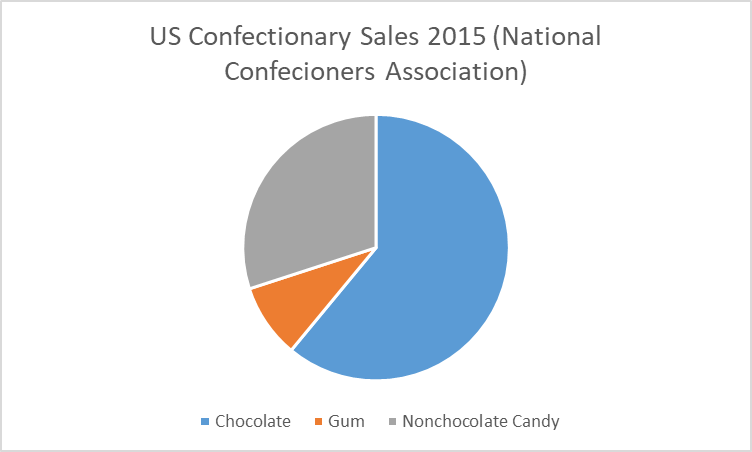

- Chocolate candies account for about 60% of US confectionery sales, nonchocolate candy for about 30%, and gum for about 10% *NCA

- The global confectionery market is set to reach approximately $275.8 billion by 2025 *businesswire.com

- 50% of the world’s cocoa production comes from Europe *Caobisco

- The confectionery industry directly employs over 55,000

- The confectionery industry has an economic impact of $35B *NCA

- 40% of consumers now eat dessert twice a week or more often, up from just 36% in 2011 *Techonomic

Room for Dessert?

Industry Forecast & Growth

Business Challenges

- $75 Million! The price of most expensive cake in the world was purchased by a buyer in the U.A.E. for his daughter’s birthday/engagement party. The cake was designed by British designer Debbie Wingham and features 4,000 diamonds.

- Other absurdly expensive desserts include a gold flaked cupcake for $1,007, a Dom Perignon topped cupcake for $1682, and an ice cream sundae with 28 types of cocoa for (only) $25,000. *Tastemade 2016

- The candy manufacturing industry includes three major segments: companies that make chocolate from beans, companies that use purchased chocolate to make candies, and companies that make nonchocolate candy. *Hoovers 2016

Industry Forecast & Growth

- Revenue (in current dollars) for US confectioneries manufacturing is forecasted to grow at an annual compound rate of 3%between 2017 and 2021, based on changes in physical volume and unit prices. Data Published: February 2017. *D&B First Research

- US imports of chocolate made directly from cocoa beans grew more than 80% between 2005 and 2015, to account for about 60% of the US market. Nonchocolate candy imports grew about 40% during the same period to account for about 20% of the US market.

Business Challenges

Raw Material Prices — Prices of key raw materials such as cocoa beans, dairy products, and sugar can change without warning. Cocoa bean prices can be volatile due to civil unrest in the key producing region of West Africa. US dairy producers may increase prices by more than 30% in a year.

Competition from Imports -- Imports from low-cost countries, such as Mexico and China, increase price competition in the US. Pressure to maintain retail shelf space increases as imports and new products expand. Imports of higher-end products from Belgium, Switzerland, and France are also key. *Hoovers

Trends and Opportunities

Go Premium — Premium chocolate has grown faster in recent times than other segments of the candy industry. Consumers view chocolate paired with exotic flavorings such as citrus or spice as a premium product and are more willing to purchase on impulse for personal consumption or for a gift. *Hoovers

Globally, the driver of growth continues to be changing tastes in Asian Pacific countries. As consumers in these areas grow more accustomed to “western” tastes, demand for chocolate has been booming. These changing tastes and an increasing per capita income in China, India and other nations of the region have some analysts predicting a 30% increase in global cocoa demand by 2020. *FranchiseHelp

Innovate — New products can help manufacturers attract the attention of impulse buyers, particularly for products with recognizable brand names. Companies invest heavily in research and development to create candies that come in a variety of different colors, flavors, shapes, and textures. Candy makers are also experimenting with new types of sweeteners and natural ingredients in response to growing consumer demand for healthier treats. *Hoovers

Over the past few years, premium chocolate sales increased 56 percent. As a result, confection- and snack-makers have their eyes on luxury and gourmet markets looking forward. Candy companies incorporated high quality ingredients and flavors like champagne and Himalayan sea salt. *NCA 2015

Fair Trade — Ethical concerns over economic and environmental issues surrounding cocoa production drive a focus on Fair Trade chocolate. Consumers are more aware of the challenges of cocoa farmers in Africa, Central America, and South America. Responsible labor practices and sustainable growing efforts are other issues. *Hoovers

New Segments

New Segments

Luxury Eclairs – Move over macarons. Paris, London, and New York are all experiencing an éclair movement. These small French custard-filled deserts, which typically sell for $7+ each, come in a variety of flavors like pistachio, matcha tea, and Tahitian vanilla. Some even come with edible gold, for that extra stamp of ‘luxury’. *Forbes.com

“Functional” Candy - Health concerns have contributed to the rising popularity of functional candy, which offers a few ‘good for you’ ingredients. Examples includes sore throat or vitamin C sweets. Other instances include the appearance of collagen and iron in candy. Collagen is a protein associated with anti-aging while iron is associated with good health and energy, is beneficial for skin complexions and often taken to prevent anemia. *Mintel 2016

Innovation based on demographic needs can help market growth. In the six months to August 2016, while three in four Chinese consumers consumed gum and three in five ate mints, 45% of these consumers ate functional candy – reflecting an opportunity for the subcategory.

*Mintel 2016

Chocolate candies account for about 60% of US confectionery sales, nonchocolate for about 30%, & gum for about 10% * NCA

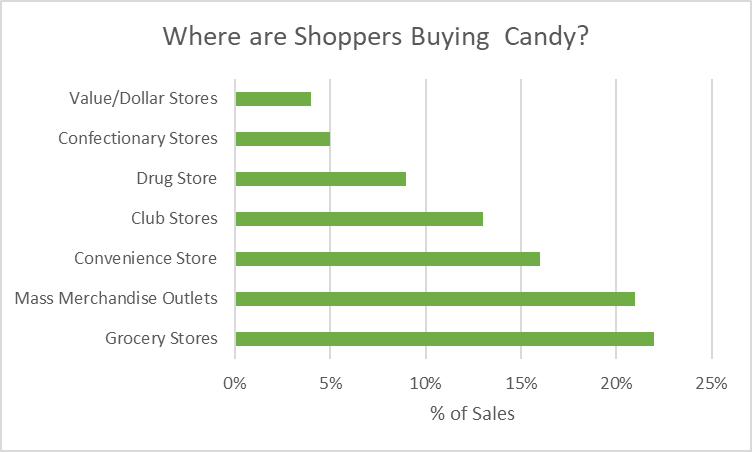

% Sales by Channel *NCA

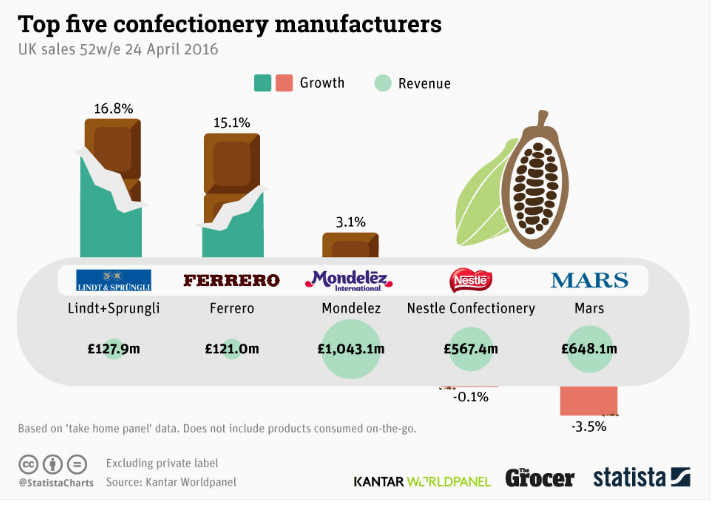

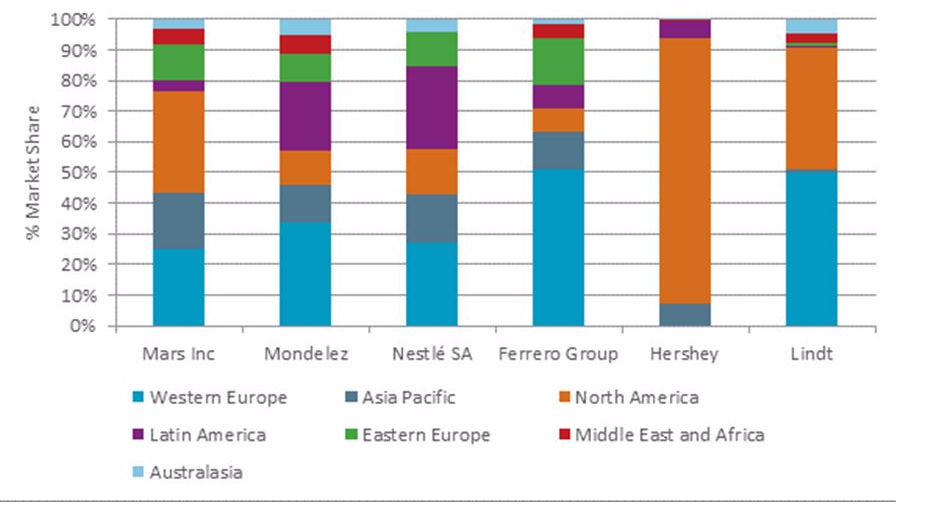

Top 5 Confectionery Manufacturers

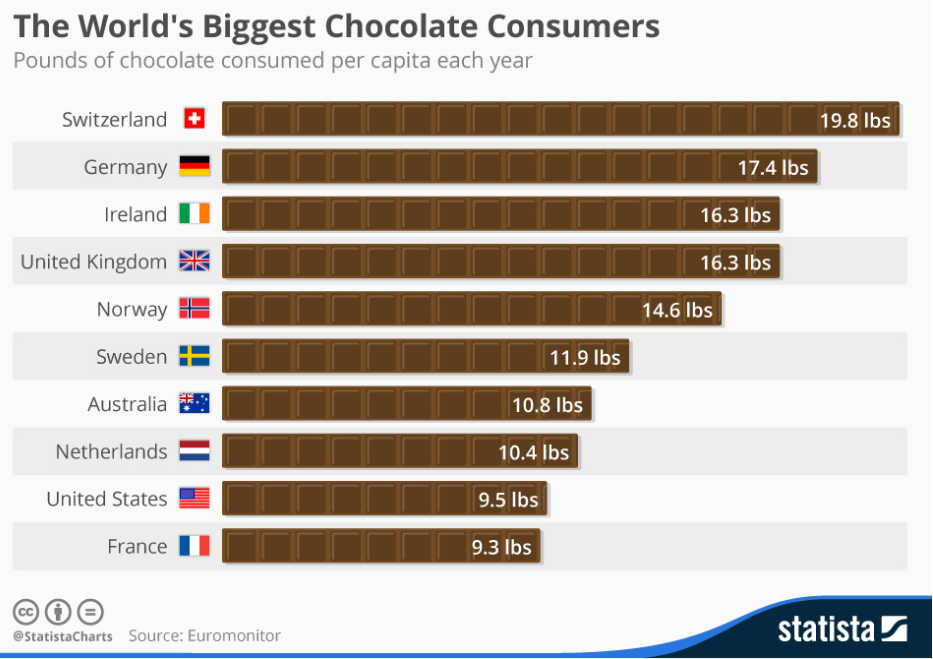

World's Biggest Chocolate Consumers

Market Share by Country and Manufacturer *Euro Monitor International