Industry Trends: European Confectionery 12/23/2016

Fast Facts

- European were exported to more than 180 destinations worldwide

- There are 12,700 confectionery companies in Europe with more than 330,000 related jobs

- 50% of the world’s cocoa production comes from Europe

- The European chocolate, biscuits & confectionery industry manufactured 11.5 million tons of products in 2013 *Caobisco 2013

- Chocolate candies account for about 60% of US confectionery sales, non-chocolate candy for about 30%, and gum for about 10%.

- The confectionery industry directly employs over 55,000

- The confectionery industry has an economic impact of $35B *National Confectioners Association.

- Revenues in candy are typically higher in the second half of the year due to holiday sales. *Hoovers 2016

Industry Breakdown

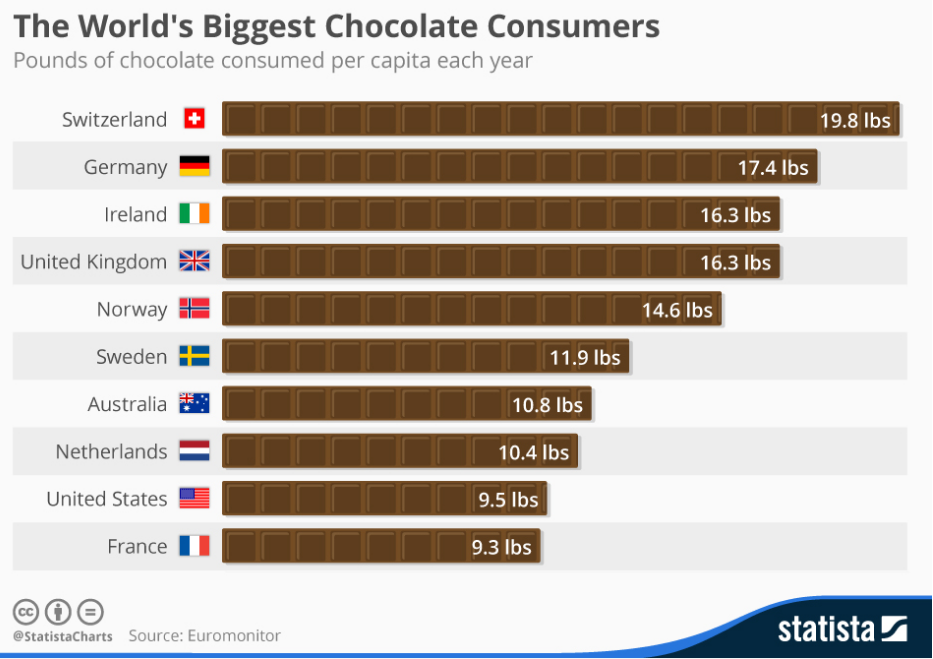

***See Figure A and B for a look at the top 5 confectionery manufacturers growth and revenue along with the countries that are the world's top chocolate consumers.

The candy manufacturing industry includes three major segments: companies that make chocolate from beans, companies that use purchased chocolate to make candies, and companies that make non-chocolate candy. *Hoovers 2016

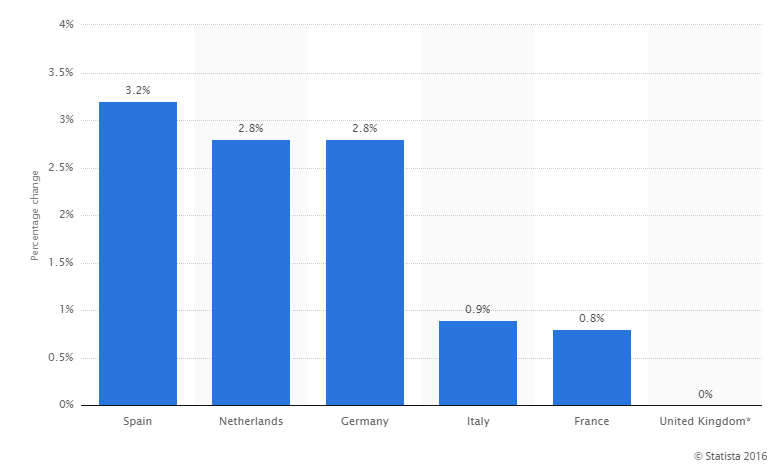

Confectionery Growth in European Countries in 2015

***See Figure C to review the countries with the most percent change in 2015 chocolate consumption.

Growth in Asia Pacific

Growth in Asia Pacific

While Western Europe remains the clear leader with $62.9B in sales, Asia Pacific passed North America for the first time in 2014 with $37.4B in sales (compared to North America’s $35.2B). *EuromonitorInternational

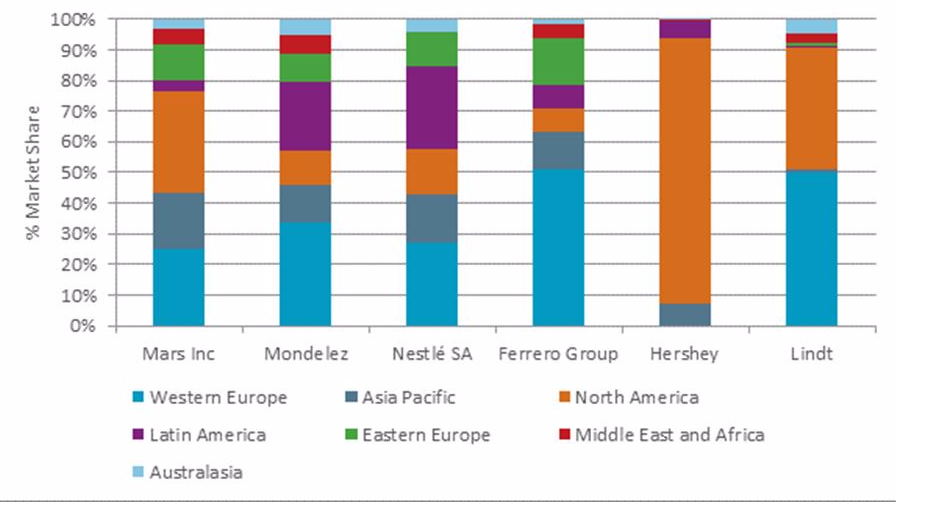

Market Share by Country and Manufacturer

***See Figure D to view the manufacturers that have the most marketshare by country.

Industry Trends & Opportunities

Dark Chocolate — Eating dark chocolate may offer health benefits, such as stress relief and improved blood circulation. Researchers have also found evidence that eating dark chocolate may be beneficial for liver disease patients.

***See Figure D to view the manufacturers that have the most marketshare by country.

Industry Trends & Opportunities

Dark Chocolate — Eating dark chocolate may offer health benefits, such as stress relief and improved blood circulation. Researchers have also found evidence that eating dark chocolate may be beneficial for liver disease patients.

Premium Products — Premium chocolate, with higher amounts of cocoa, has grown faster in recent times than other segments of the candy industry. Consumers view chocolate paired with exotic flavorings such as citrus or spice as a premium product and are more willing to purchase on impulse for personal consumption or for a gift. *Hoovers

Smaller Portions — Consumers continue to grow more concerned about health issues, and are seeking to control their calorie intake. Selling smaller, bite-sized candy that has fewer calories per serving also offers greater convenience, share-ability, and portability. *Hoovers 2016

Industry Challenges

Health and Wellness Trend – The overall trend of increasing obesity and diabetes will put pressure on sugar consumption. A survey of UK National Diet and Nutrition found that confectionery was the #2 source of sugar for children and teends (behind soft drinks). As a result, the European market is at risk to decline as regulators and consumers consider impact upon public health. There has even been a push to remove confectionery items from supermarket check-out lines. *Confectionerynews.com

Industry Challenges

Health and Wellness Trend – The overall trend of increasing obesity and diabetes will put pressure on sugar consumption. A survey of UK National Diet and Nutrition found that confectionery was the #2 source of sugar for children and teends (behind soft drinks). As a result, the European market is at risk to decline as regulators and consumers consider impact upon public health. There has even been a push to remove confectionery items from supermarket check-out lines. *Confectionerynews.com

Recently, the World Health Organization recommend that added sugars not exceed 10 percent of total energy. In order to assist with this goal, the FDA has proposed added sugars to be listed separately from total sugars on the Nutrition Facts Panel with a 10 percent Daily Value. *NCA 2016

Raw Material Costs - Prices of cocoa beans, dairy products, and sugar, can change without warning. Cocoa bean prices can be volatile due to civil unrest in the key producing region of West Africa. The key to mitigating this risk is buying raw materials at the most strategic time. The industry is also sensitive to energy price fluctuations aschocolate depends highly on energy to melt, conche, temper, mix, and cool the product. *Hoovers 2016

International Trade — Tariffs, embargoes, and other restrictions on international trade may create financial risks for candy manufacturers that import key ingredients such as sugar and cocoa beans. The US government imposes price controls and import caps on certain commodities entering the country, such as sugar from Mexico, to help domestic producers remain competitive. This can increase overhead costs for candy makers as ingredient prices rise, leading some companies to seek out suppliers in other countries that have fewer trade restrictions. *Hoovers 2016

Figure A

Figure B

Figure C

Figure D *EuromonitorInternational