Industry Trends: Convenience 9/23/2016

Convenient Facts

- Consumers spend about $1.7 billion dollars daily in c-stores

- 154,000-plus stores that account for $575 billion in sales

- Approximately $1 out of every $23 dollars spent in America is spent at c-stores

- C-stores sell an average of 11 million cups of coffee every day

- The average c-store visit takes 3 ½ minutes compared to 41 minutes in the typical grocery store

- $30 Billion is spent on lotto tickets in convenience stores annually

- C-stores sell two billion gallons of beer every year - approximately one-third of all beer sold in America. (beer accounts for 10% of in-store sales.) *CSNews

- Sales are seasonal and tend to peak during warm months. *Hoovers

- The 7 Eleven chain has sold over 7.2 billion Slurpees since 1966. Slurpees account for $170 million in sales each year. *USAToday

Industry Indicators 2016

- US consumer spending on nondurable goods, an indicator of convenience store sales, fell 1.6% in June 2016 compared to the same month in 2015.

- The average US retail price for diesel and regular gas, which influences discretionary consumer spending on convenience items, fell 11.7% and 20.9%, respectively, in the week ending August 15, 2016, compared to the same week in 2015.

- US retail sales for gasoline stations, a potential measure of demand for convenience items, decreased 10.4% in the first seven months of 2016 compared to the same period in 2015.

- US tourism spending on all tourism goods and services, an indicator of tourism spending at convenience stores, increased 5.9% in the first quarter of 2016 compared to the same period in 2015. *Hoovers

Business Challenges

- Competing with Large Retailers - Stores face increasing competition as more large retailers add gas to their merchandising mix. Large retailers, including grocery stores, mass merchandisers, and warehouse clubs, have added gas stations to drive traffic and typically offer competitive prices for fuel and lower prices for nonfuel items. Fast service, easy access to stores, and close parking help companies develop a convenience-based advantage over competitors.

- Inventory - One of the greatest challenges for convenience stores is inventory control. Due to small size, maintaining a lean, efficient inventory is crucial to c-store sales success. Because of these limited inventories and the widespread locations of many c-stores, supply chain management is also a challenge. *CSForum

- Narrow Margins on Gas - While stores rely on fuel sales to drive store traffic, gas carries extremely low margins. Competition and price sensitivity limit companies' ability to raise retail gas prices to cover increased costs. When wholesale gas prices increase suddenly, stores may make just pennies per gallon. With thin margins on gas, stores must depend on nonfuel merchandise sales to generate profits. *Hoovers

Trends and Opportunities

- Focus on Services — Services such as banking, dry cleaning, and pharmacies reduce dependence on gas sales to drive traffic. Almost all c-stores have ATMs or sell money orders, while other are adding Internet kiosks, Wi-Fi, and drive-thru services. In Japan, some c-stores are installing currency exchange machines and computer tablets that provide tourist information. *Hoovers

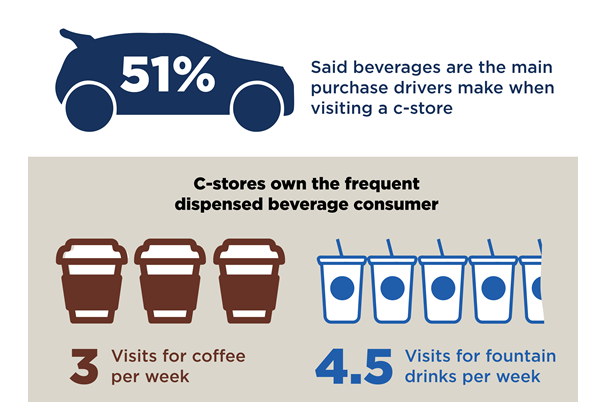

- Focus on Beverages - Over 98% of convenience store locations offer consumers cold dispensed beverage. The segment is a leading driver in c-store visits and there are few categories within the convenience store industry that draw destination sales quite like cold dispensed beverages. (*McClane Strategic) The ability to quickly reflect the changing tastes and cultural propensity of the American consumer has allowed cold dispensed beverages to grow side-by-side with the c-store industry for more than five decades. *Cstoredecisions More than three-quarters of US adults drink coffee regularly. (*National Coffee Association). Unlike most impulse items, coffee bought at a c-store is almost always a planned purchase. (*Learning Exchange). As drinking coffee is a habit, c-stores can develop customer loyalty and drive repeat sales by investing in quality coffee stations. Coffee generally has high margins and can help drive related-item sales for products such as donuts, muffins, and pastries. *Hoovers

- Focus on Food -- Foodservice remains the biggest area of opportunity for c-stores. As revenues from gasoline and tobacco products fall, foodservice sales are increasingly becoming convenience stores’ most profitable category. Convenience store foodservice is a $13 billion industry and the second largest retail host foodservice category behind supermarkets. The c-store segment comprises about 30% of retail foodservice and almost 3% of the total foodservice industry. *cstoredecisions.com

- Go Healthy -- C-store competitors are upping their game with fresh foods and healthier ingredients. *cstoredecisions.com Freshly prepared foods, such as salads, fruit cups, and smoothies, attract health-conscious consumers. Foodservice products can generate significantly higher margins than gas. *Hoovers

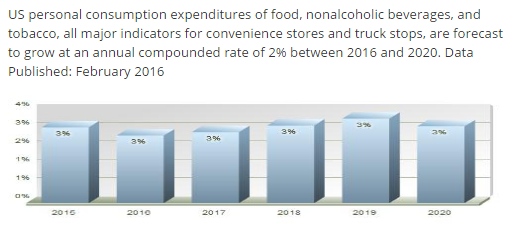

Industry Forcast (*D&B First Research)

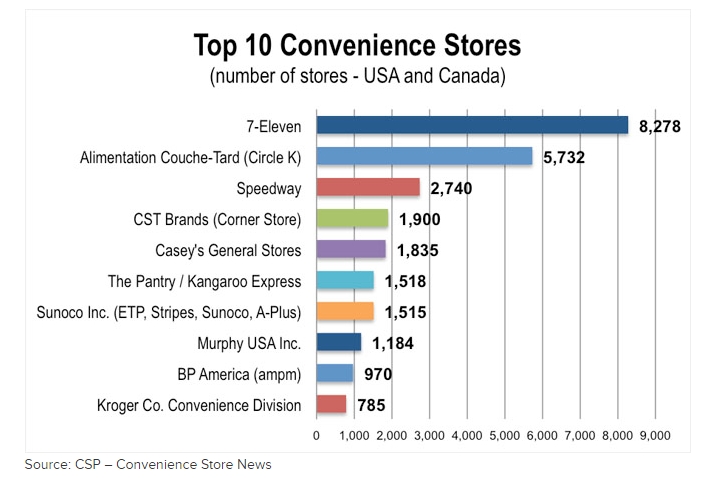

Industry Breakdown (*CSP - Convenience Store News)

Beverages as a purchase driver (McClane Strategic)