Industry Trends: Euro Prestige Beauty & Perfume 8/4/2016

Fast Facts:

- The global personal luxury market grew by nearly 2.5% in 2013

- The global cosmetics market grew by nearly 4% in 2013

- China, Brazil and the US contributed to almost half of the global cosmetics market in 2013 (Ernst & Young)

- The beauty industry in the UK employs more than one million people and is worth £17 billion

- The UK beauty industry is forecast to grow 16% by 2016

- Despite the recession, retail sales in the UK beauty market grew 15.5% from £6.1 billion in 2008 to an estimated £7.1 billion in 2013. (Raconteur.net 2016)

- The worldwide perfume industry is valued at over $30 billion (Mintel 2013) and is expected to grow to over $45 billion by 2018 (Global Industry Analysts, Inc.)

- There were 1,160 women’s fragrances sold in the U.S last year (NPD Group) There are over 100 new fragrances launched each year (Euromonitor International)

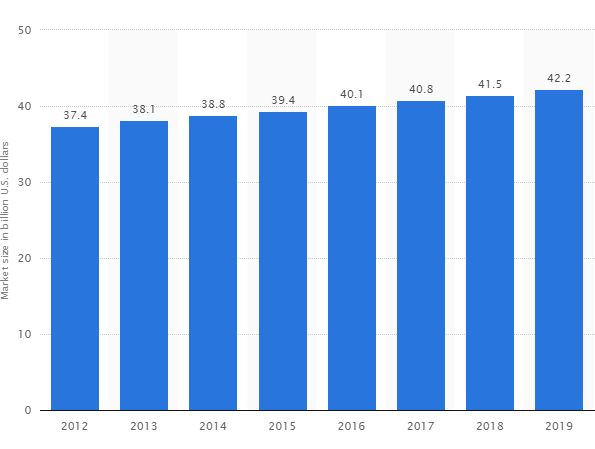

The estimated size of the global fragrance market from 2012 to 2019. In 2016, the global fragrance market is estimated to be worth about USD 40.1 billion.See Figure B (Statista)

Trends and Opportunities

Growth of Cosmeceuticals — An aesthetic desire and the aging population are driving demand for cosmeceuticals (a combination of cosmetics and pharmaceuticals). Cosmeceuticals include skincare, haircare, and makeup products that beautify as they address health problems or concerns. As the senior population increases in size and spending power, focus on anti-aging products will increase. Although early cosmeceuticals were primarily topical skincare products, today they include skincare anti-aging and products for stress relief and sun protection.

Export Growth — Exports rose about 1% in 2015 and about 5% in 2014. The largest markets are Canada and the UK, which together account for about one-third of total US exports of personal care products.

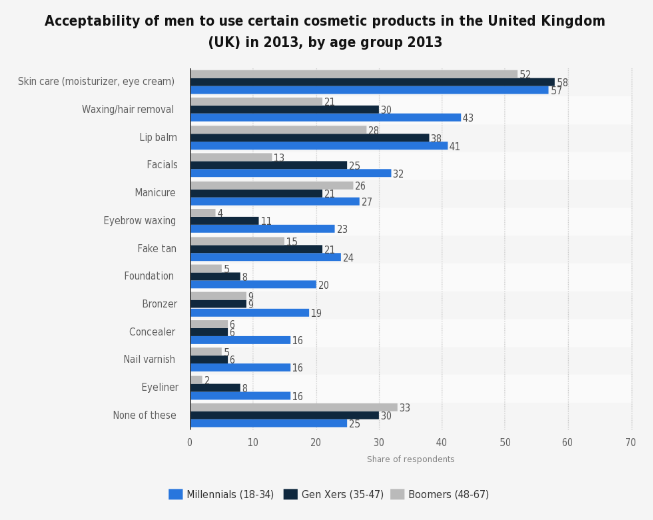

New Target Markets — The men's, tweens (9- to 12-year-olds), and ethnic markets are growth opportunities for personal care product manufacturers. The primary focus for personal care products has traditionally been women. Men, tweens, and ethnic segments are relatively untapped for products designed to meet their needs. See figure D (Hoovers 2016)

Export Growth — Exports rose about 1% in 2015 and about 5% in 2014. The largest markets are Canada and the UK, which together account for about one-third of total US exports of personal care products.

New Target Markets — The men's, tweens (9- to 12-year-olds), and ethnic markets are growth opportunities for personal care product manufacturers. The primary focus for personal care products has traditionally been women. Men, tweens, and ethnic segments are relatively untapped for products designed to meet their needs. See figure D (Hoovers 2016)

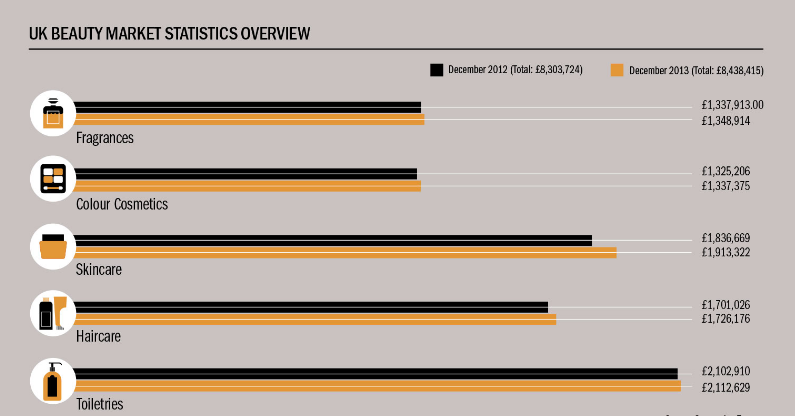

Figure A

*Cosmetics Europe 2014

Figure B

*Statista

Figure C

*Hoovers 2016

Figure D

*Statista 2013