Industry Trends: Fragrance, Bath & Cosmetics 7/12/2016

Quick Facts

- The U.S. cosmetics industry revenue last year was over $56 billion (Statista)

- The cosmetic industry employs over 56,000 workers in the U.S. (Statista)

- The perfume industry is valued at over $30 billion (Mintel 2013).

- The fragrance category is expected to grow to over $45 billion by 2018 (Global Industry Analysts, Inc.)

- Annual perfume fragrance revenue in the U.S. alone is over $4 billion (IBISWorld)

- There were 1,160 women’s fragrances sold in the U.S last year (NPD Group)

- There are over 100 new fragrances launched each year (Euromonitor International)

- Paris Hilton just launched her 20th fragrance (PRNewswire)

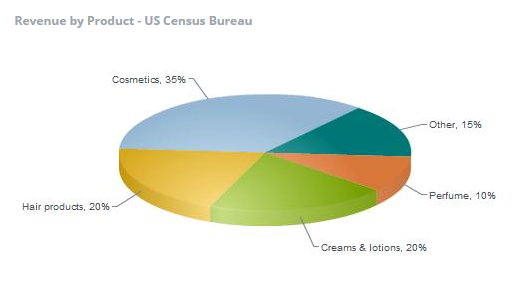

- Cosmetics, face cream, and perfume make up about 75% of industry sales; with about 20% of sales come from hygienic products such as deodorant, hair, and shaving products. (Hoovers)

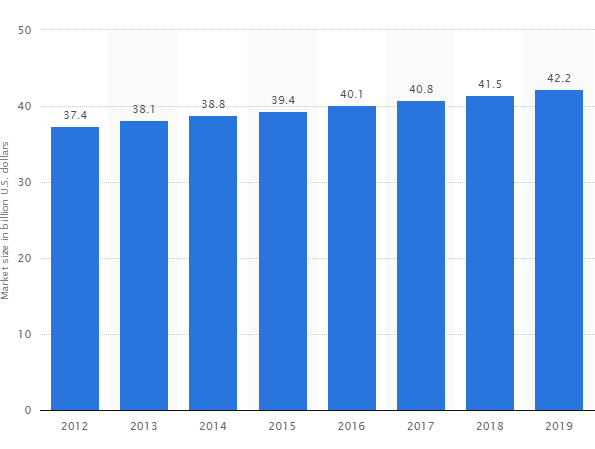

- In 2016, the global fragrance market is estimated to be worth about USD 40.1 billion. (Statista)

- US personal income, which drives how much consumers might spend on cosmetics, beauty supplies, and perfume, rose 4.2% in March 2016 compared to the same month in 2015. (Hoovers)

- US retail sales for health and personal care stores, a potential measure of cosmetics, beauty supply, and perfume demand, increased 7.1% in the first four months of 2016 compared to the same period in 2015. (Hoovers)

Trends and Opportunities

Cosmeceuticals — As the senior population increases in size and spending power, focus on anti-aging products will increase. Cosmeceuticals (a combination of cosmetics and pharmaceuticals) include skincare, haircare, and makeup products that beautify as they address health problems or concerns. (Hoovers)

Internet Sales — More consumers are buying beauty products on the Internet as a convenient way to replenish cosmetic brands that they already know and trust. Research shows that the higher the income, the greater the likelihood that a woman will shop for beauty products via the Internet, making it a good fit for high-end prestige products. (Hoovers)

Custom Scents – In London, a new boutique called Perfumer H is giving fragrance shoppers a whole new experience. There they can choose to create a custom fragrance from scratch (a collaborative process that can take up to six months) or even buy a premade one-of-kind scent known as a Laboratory Edition (after the customer takes the bottle from the shop, an additional fee ensures that the formula is put under lock and key and reserved as exclusively his or her own). (Vogue) Custom fragrance options are popping everywhere from online to major cities in the U.S. and abroad.

Organic and Natural Products — Increased focus on health, a rising incidence of allergies, and concern about chemical safety have all increased demand for organic and natural cosmetics. Products are generally 30% to 50% more expensive than traditional, providing growth opportunities for manufacturers. Large manufacturers see this opportunity and are buying smaller natural brand companies. For example, Burt's Bees was acquired by Clorox in 2007. As more manufacturers enter this market, regulatory focus on natural claims, organic certification, and labeling will rise. (Hoovers)

Industry Challenges

Demand Tied to Economic Cycle — Luxury items within the industry, such as high-end perfume, makeup, or skin care products, are particularly vulnerable to economic downturns. Consumers tend to reduce discretionary purchases and may switch to less expensive beauty products during tough economic times. (Hoovers)

Safety and Quality Concerns — Personal care products such as cosmetics and shampoos are tested for safety and efficacy. Animal testing, although controversial, may be required by law for some products. Consumer concerns over the safety of ingredients can cause problems for a company or its brand, resulting in losses or erosion of brand credibility. (Hoovers)

Custom Scents – In London, a new boutique called Perfumer H is giving fragrance shoppers a whole new experience. There they can choose to create a custom fragrance from scratch (a collaborative process that can take up to six months) or even buy a premade one-of-kind scent known as a Laboratory Edition (after the customer takes the bottle from the shop, an additional fee ensures that the formula is put under lock and key and reserved as exclusively his or her own). (Vogue) Custom fragrance options are popping everywhere from online to major cities in the U.S. and abroad.

3D-Printed Makeup — A new 3D printer that can produce makeup could prove to be disruptive for the beauty industry. The printers use FDA-compliant, cosmetics-grade inks to produce lipstick, eye shadow, blush, nail polish, and other products in practically any color. (Hoovers)

Men’s Grooming – The men’s grooming industry is expected to bring in over $21 billion this year. All of this is indicative of a paradigm shift of sorts in men's overall perception of grooming and self-care. (Complex Magazine) Companies can capitalize on the growing market for men’s beauty care, as male baby boomers age and become more conscious of their appearance. Top markets for men's beauty product growth in recent years include Brazil, China, the U.S., Germany, India, and the UK. (Hoovers) The market for men's grooming and personal care products will increase 13% by 2018 compared to 2013. (Mintel) And, it is just the tip of the iceberg. It is estimated that 75% of men are not using any sort of facial skin care, but interest continues to grow. (FranchiseHelp.com)

Men’s Grooming – The men’s grooming industry is expected to bring in over $21 billion this year. All of this is indicative of a paradigm shift of sorts in men's overall perception of grooming and self-care. (Complex Magazine) Companies can capitalize on the growing market for men’s beauty care, as male baby boomers age and become more conscious of their appearance. Top markets for men's beauty product growth in recent years include Brazil, China, the U.S., Germany, India, and the UK. (Hoovers) The market for men's grooming and personal care products will increase 13% by 2018 compared to 2013. (Mintel) And, it is just the tip of the iceberg. It is estimated that 75% of men are not using any sort of facial skin care, but interest continues to grow. (FranchiseHelp.com)

Organic and Natural Products — Increased focus on health, a rising incidence of allergies, and concern about chemical safety have all increased demand for organic and natural cosmetics. Products are generally 30% to 50% more expensive than traditional, providing growth opportunities for manufacturers. Large manufacturers see this opportunity and are buying smaller natural brand companies. For example, Burt's Bees was acquired by Clorox in 2007. As more manufacturers enter this market, regulatory focus on natural claims, organic certification, and labeling will rise. (Hoovers)

Industry Challenges

Demand Tied to Economic Cycle — Luxury items within the industry, such as high-end perfume, makeup, or skin care products, are particularly vulnerable to economic downturns. Consumers tend to reduce discretionary purchases and may switch to less expensive beauty products during tough economic times. (Hoovers)

Safety and Quality Concerns — Personal care products such as cosmetics and shampoos are tested for safety and efficacy. Animal testing, although controversial, may be required by law for some products. Consumer concerns over the safety of ingredients can cause problems for a company or its brand, resulting in losses or erosion of brand credibility. (Hoovers)

The estimated size of the global fragrance market from 2012 to 2019. (Statista)

Industry Breakdown (Hoovers)

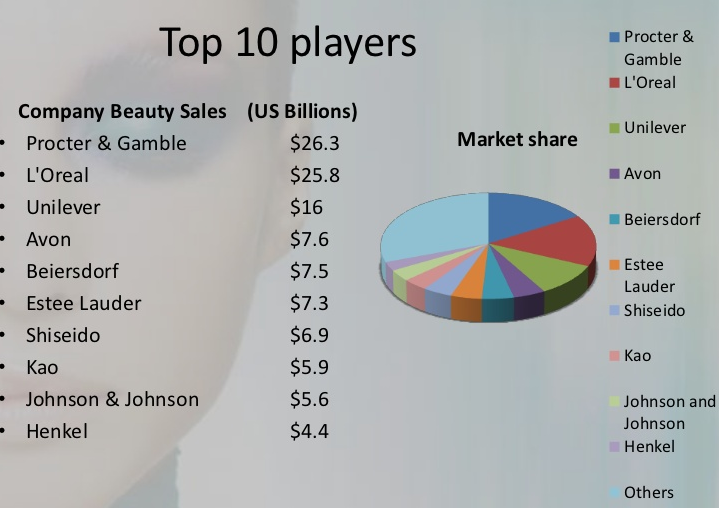

Top 10 Industry Players (Forbes)