Industry Trends: Pet 1/26/2016

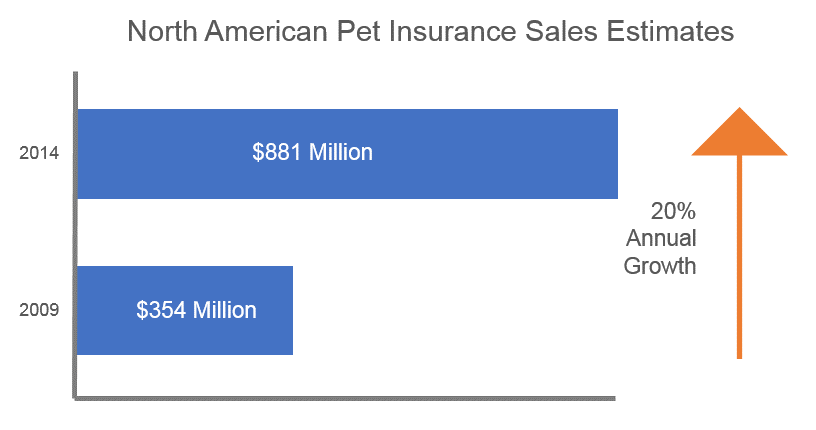

Americans own more pets than at any other time in history. Not only is pet ownership increasing, but people are spending far more on pampering their pets. For most people, pets truly are family. This industry has experienced significant growth – even surviving the recession - and the outlook is positive in the long-term.

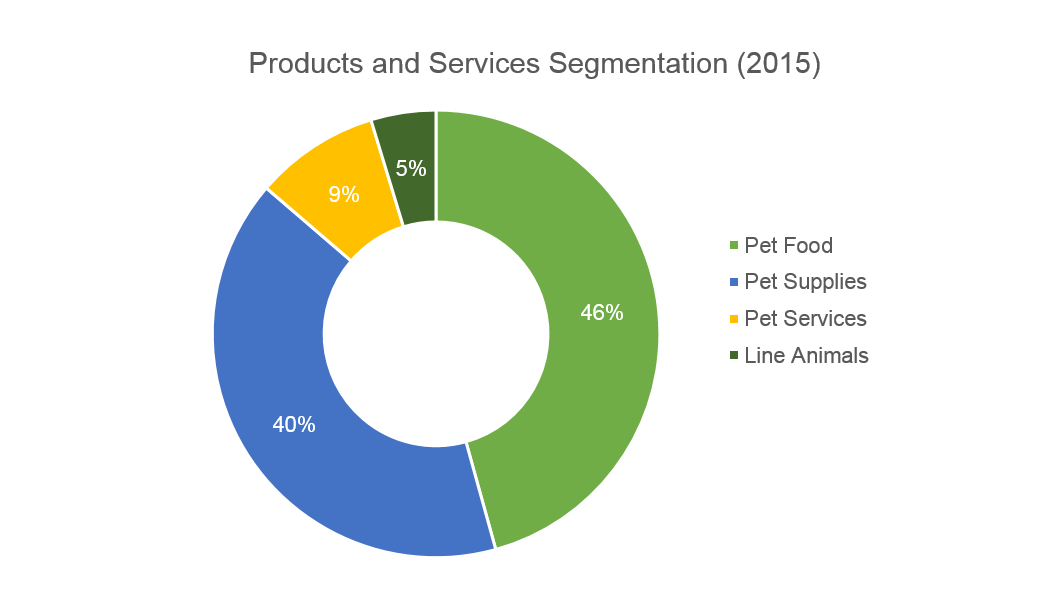

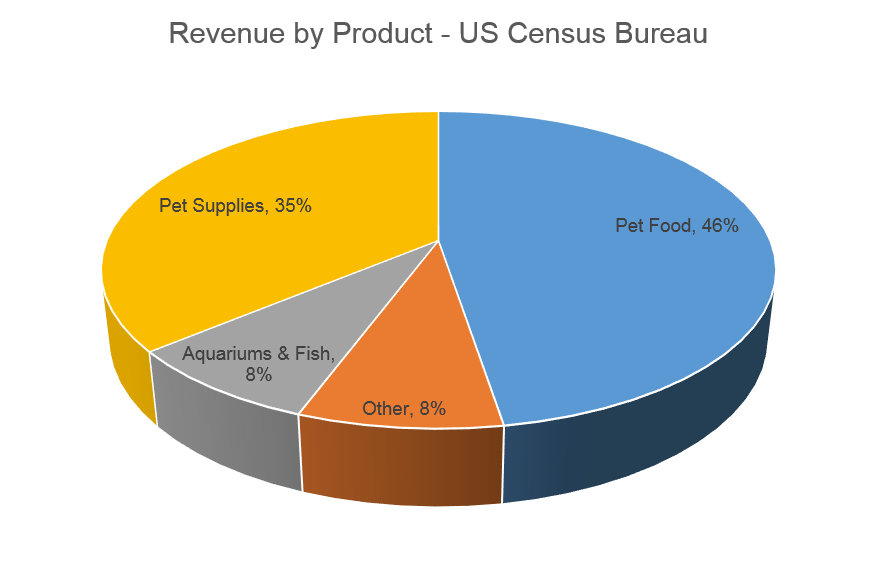

- Americans spent $58 billion on pet products and services in 2014 (up 4% from 2013)

- Over 71 million homes have pets

- Since 1988, pet ownership has expanded from 56% to 68% of households

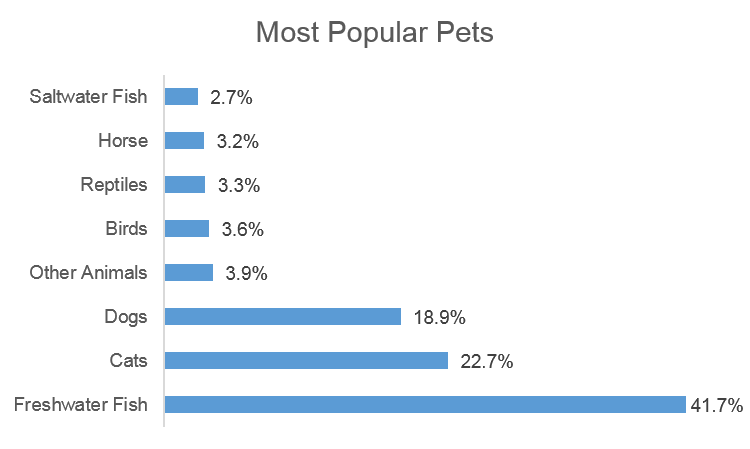

- 70-80 million dogs and 74-96 million cats are owned in the United States. Approximately 37-47% of all households in the United States have a dog, and 30-37% have a cat. (*ASPCA)

- 92% of pet owners spent the same or more on their pets during the most recent recession period. (Forbes)

- The pet industry is the seventh largest retail industry in the U.S., exceeding the jewelry, candy, toy and hardware industries. (Forbes)

Humanization — More than ever, owners think of their pets more like children or friends, driving demand for premium products and services. Americans spend more on pet supplies than on toys or video games. Lavish spending has fueled growth in specialties such as gourmet pet food, deluxe pet hotels, and pet photography. (*Hoovers) Manufacturers have introduced pet food products that mimic popular human culinary trends such as the Paleo diet and the raw food movement. The expanding selection of gourmet products helped spur a 45% increase in premium dog food sales from 2009 to 2015. (*Bloomberg).

Condition: Payout per claim

1. Torn Knee Ligament/Cartilage: $1,578

2. Intestinal - Foreign Object: $1,967

3. Stomach - Foreign Object: $1,502

4. Intervertebral Disc Disease: $3,282

5. Stomach Torsion/Bloat: $2,509

6. Broken Leg (Plate): $1,586

7. Laryngeal Paralysis: $2,042

8. Tumor of the Throat: $1,677

9. Ear Canal Surgery: $1,285

10. Ruptured Bile Duct: $2,245

(*Veterinary Pet Insurance Company)

Pet Opportunities

Luxury Goods — Humanization and exposure of celebrity pets culture has resulted in demand for luxury brand name products. Leona Helmsley left $12 million to her dog when she passed in 2007. High-end mainstays like Chanel, Burberry, and Coach all make dog collars and leashes. With intense competition at the low end of the market, small, independent pet stores can differentiate from large chains by stocking unique, high-end products. (*Hoovers)

Consider the following luxury pet items highlighted by CNBC:

- $340 automatic, self-cleaning litter robot

- $350 bone crystal poop bag holder

- $3,000 VIP fragrance for dogs

- $10,000 designer dog bridal veil

- $3.2 million diamond-studded dog collar

Costumes – In 2015, 20 million people were planning on dressing up their pets for Halloween resulting in $350 million spending. One in five millennials will dress their pets compared to 13% of all adults. (*National Retail Federation)

Private-Label Market — A significant number of retailers stock private-label pet foods, which are often more profitable for retailers than branded products. Wal-Mart’s private-label products represent a significant portion of the total US pet food market. (*Hoovers)

Health and Wellness – 55% of cats and 54% of dogs are obese. (*U.S. Pet Market Outlook) This present a host of opportunities for offering products and services aimed at healthier pet lifestyles. Providing a year-round health and wellness display with rotating product categories is a great way to keep shoppers engaged. A specific month could feature the best cat and dog supplements, and another could educate shoppers about new wet food additives on the market. Other themes might be healthy skin and coat products, oral health or grain-free food options. (*PetAge.com)

- Product Showcase: Pet

- Digital’s Influence on Pet Purchases: Study

- ECRM Presentation - Pet: Social Media, Story & Your Brand