Snack Category Trends: Healthy Snacks Driving Growth 11/18/2015

Snacking is one of the fastest growing trends, and it’s replacing traditional meals on a more regular basis than ever before. Half of Americans use snacking as a meal replacement, as these time-starved consumers are constantly looking for quick ready-to-eat alternatives. Indeed, the term, "grab-and-go" has become a primary focus strategy for most CPG brands and retailers.

Healthier products are at the heart of the conversation around snacking, primarily due to the changing values of consumers and the erosion of trust toward large brands. Consumers are changing their focus from heavily processed calorie-laden snacks to healthy alternatives. Transparency is key; consumers want to know where their snacks come from, how they are produced, with no artificial colors and flavors, and with simple ingredients that are easy to understand. Consumers are reaching for alternative beverages instead of soda, fruits and vegetables instead of candy and chips, and greek yogurt instead of cookies and pudding. Non-sugar snacks have become a top seller in the segment.

Nielsen: Three Types of Snackers

According to Nielsen, there are three different types of snackers: planners, purposeful snackers, and spontaneous snackers. Most snacking is not planned. While planners choose their snacking options in advance and have a snacking routine, purposeful snackers concentrate on finding snacking alternatives that are more health-conscious. Spontaneous snackers are impulsive and usually consume more snacks shortly after purchase. They are more apt to experiment with a variety of different snacks. According to a Nielsen study, the average person consumes 12 different kinds of snacks a month.

Snacking sales increased 3.2 percent across the entire store, while sales of healthy alternatives grew 8.4 percent over the same period, with the key focus being on convenience, variety, and portability. Interestingly, however, indulgent snacks have grown double digits.

Women consume more snacks than men, with non-sugary snacks leading segment growth. The Nielsen study indicated that “64 percent of consumers eat snacks to improve their mood, 53 percent as a reward, and 44 percent because they are stressed."

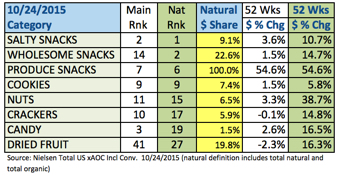

The majority of all snacking sales comes from center store. With the increase of natural and organic products, retailers are able to capitalize on strong growth trends in snacking categories that were once flat and declining. Natural snack sales increases are several times that of their mainstream counterparts in all of the traditional snacking categories. More importantly, wholesome snacks and produce snacks rank at the top of overall category growth.

Natural snacks are an entry point to other natural product categories and product offerings throughout the store. In addition, consumers who purchase healthy snacks frequently look for healthy meal and product solutions in other departments. Retailers who want to grow sustainable sales and increase foot traffic need to capitalize on these important trends. Natural products need to be fully integrated into mainstream categories. And retailers who make snacking easy through effective merchandising, pricing, and promotion strategies that focus on shoppers wants and needs will help drive sales throughout the store.

--------------------------------------------------

Sources: Nielsen’s SNACKING ACROSS THE AISLES: A CHANGING ENVIRONMENT 09-30-2015; Nielsen’s White Paper; SNACK ATTACK, WHAT CONSUMERS ARE REACHING FOR AROUND THE WORLD SEPTEMBER 2014; Nielsen Total US xAOC Incl Conv. 10/24/2015 (natural definition includes total natural and total organic)

Daniel Lohman, CPSA is strategic advisor in the CPG and Organic Industry. His company, Category Management Solutions (CMS4CPG), provides innovative ideas, actionable insights and strategic solutions for companies interested in expanding their retail distribution and improving their merchandising. He spoke at ECRM’s Private Brand Food event April 13, 2015 in Orlando, and can be reached at dan@cms4cpg.com or 303-748-3273.